Creditworthiness

Given that USDA does not lay a minimum credit history requisite , extremely lenders like a score away from 640 or higher. A great credit score reveals your capability to manage financial obligation sensibly, which is a button grounds to have lenders regarding your loan software.

Note : A credit history is simply a mathematical symbolization of your creditworthiness according to your borrowing from the bank records, repayment patterns, and an excellent bills.

Loan providers use credit ratings to evaluate the possibility of credit your money. A top credit score indicates a lesser exposure to the financial, because ways a robust track record of handling your financial loans.

Whether your credit history falls underneath the 640 draw, there are still things to do to switch the probability out-of being qualified getting a beneficial USDA Loan. Listed below are some suggestions:

- Get a duplicate of one’s credit report and you can opinion they cautiously . Pick one problems or inaccuracies that would be turning down the get. You could disagreement any problems you will find on the credit agencies.

- Write a plan to reduce personal debt . Cutting your borrowing from the bank utilization proportion (the degree of credit make use of than the your total borrowing from the bank limit) can be somewhat change your score.

- Make uniform as well as on-go out money to the all your valuable existing debts . Commission background the most high situations affecting your credit score.

- Think obtaining a beneficial USDA Financing having a good co-signer . A great co-signer are anyone having a strong personal loans in Vermont credit rating just who agrees to lead to the borrowed funds for people who default. That have good co-signer may help improve your software and you may improve your odds of approval.

Debt-to-Money Proportion (DTI)

The debt-to-earnings proportion is the part of the disgusting monthly earnings you to definitely would go to loans costs. For USDA Money, the DTI would be to generally not meet or exceed 41%. This means their full monthly bills, including your upcoming mortgage payment, is going to be less than 41% of the pre-taxation money.

Citizenship/Residency

- All of us Citizen : When you find yourself good You resident, you automatically satisfy which criteria.

- You Non-Citizen Federal : That it status relates to anybody produced in some United states regions, such as for example American Samoa.

- Qualified Alien : This category comes with lawful long lasting customers (eco-friendly credit proprietors), asylees, refugees, or any other non-customers with certain immigration statuses. You will need to offer records to show their licensed alien position.

- Good Social Cover Count : No matter the citizenship or residence position, you must have a valid Personal Protection matter so you can qualify for a beneficial USDA Mortgage.

This requisite guarantees USDA Mortgage applications are available to those individuals legally registered to reside and work with the usa.

Now that we’ve got shielded the fresh borrower criteria let us check out the USDA financial house criteria. Its not all house is eligible for good USDA Loan, therefore insights these criteria is crucial in your home search.

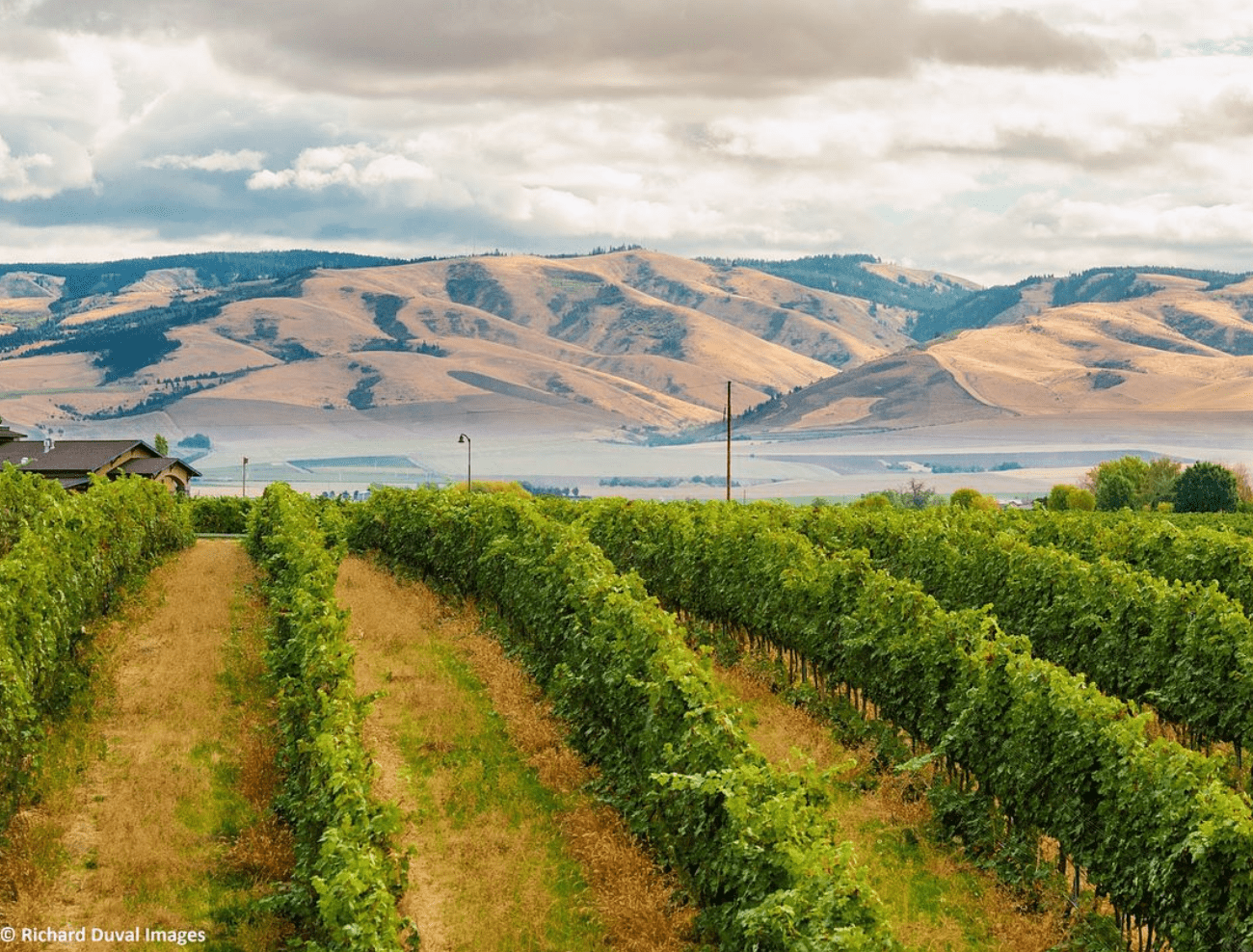

Location: USDA Mortgage House Criteria

Remember the USDA eligibility chart we discussed earlier? Our house we should get have to be found inside an excellent USDA-designated rural town. Although this might sound restrictive, the new USDA’s concept of rural was truth be told greater, close of several portion you may not generally speaking imagine. To confirm your dream residence’s qualifications, use the interactive qualifications chart or consult with a loan Officer. They’re able to quickly ensure in the event the property matches the spot standards.

No. 1 Household

USDA Loans try only for number one houses, definition our house you buy need to be your primary dwelling, not a holiday domestic or a residential property . You must decide to undertake the house or property since your prominent quarters getting a significant part of the season. That it requirement assures USDA Loans are used to offer homeownership to own anyone and you can family members, not to have commercial purposes.