Blog post bottom line

- Homebuyers whom lack the finance to own in initial deposit keeps another solution open to her or him: the newest one hundred% mortgage, put differently, a home loan with no deposit necessary.

- Banking institutions from inside the Southern Africa are presently approving much more a hundred% lenders, so that you can improve the assets market.

- Regardless if getting down a deposit has some benefits, the new a hundred% mortgage presents first-time home buyers, who may have minimal info, having a practical means on property sector.

While you are there are many different benefits to placing off a deposit into your house, the fresh one hundred% financial will bring a selection for those who have difficulties mustering money having an upfront fee.

Even in the event anyone can take advantage of they, it’s particularly geared toward the needs of basic-time homebuyers. Finance companies supply the a hundred% financial to help you encourage men and women to take the basic step on the possessions hierarchy.

How to score a 100% home loan?

You get a hundred% financial with the banks. Whether they will in all probability approve the application utilizes:

- Their credit score .

- Your capability to cover monthly money (and is higher which have an one hundred% financial).

- The value of the house .

You can examine your own personal credit record by prequalifying for property financing which have ooba Mortgage brokers. This process, along with that gives an estimation out-of everything you are able check loans Acres Green CO, will establish your chances of qualifying to possess a home loan.

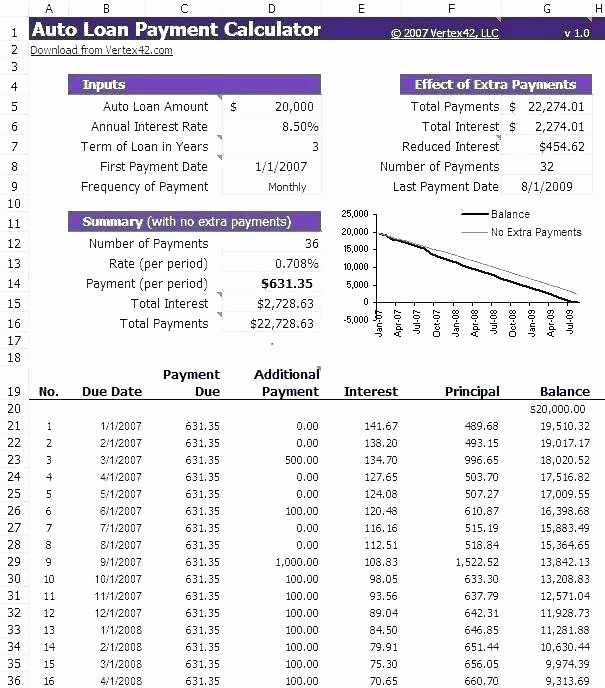

You can use our Thread Cost Calculator to see which the monthly costs would be to your a 100% financial.

For example, in the event the purchase price of the house are R1 one hundred thousand 100, the text term are 2 decades, the pace nine.75%, plus the deposit are zero; the month-to-month payment could be R8 521 (amounting to a total of R2 045 040 over twenty years).

100% mortgage versus deposit

Therefore placing off in initial deposit is almost always the more sensible choice in the event that you’re in a position . It increases your odds of acquiring the home loan application accepted, and you will saves you tall costs on the much time-identity.

Make more than illustration of good R1 100 one hundred thousand purchase; that have a great ten% deposit (R100 100000) the fresh new month-to-month fees might possibly be R7 250, in addition to complete matter payable over twenty years was R1 740 081. So, that’s R193 343 stored more 20 years.

However, throughout the quick-identity, this new one hundred% home loan function you are getting a home worth R1 000 100000 without having to stump up a beneficial R100 000 deposit.

Why now is an enjoyable experience to try to get an one hundred% financial

reported because the interest rate away from mortgage loans has accelerated, which is from the highest top because introduction of this new National Borrowing from the bank Operate inside 2007.

Enhanced race ranging from banking institutions possess led to high home loan approval, plus a hundred% home loans. Furthermore contributed to straight down rates to own home buyers.

In the ooba Lenders, 80% of our own a hundred% financial software are being acknowledged, that have four from four people properly protecting an one hundred% financial.

A mortgage analysis provider: Your absolute best threat of bringing a 100% home loan

When you find yourself a home consumer who is struggling to gather the finance having in initial deposit, you aren’t by yourself. 60% out of apps received by the ooba Home loans are from customers whom don’t have any access to a deposit.

Enlisting the expertise of a mortgage investigations solution, eg ooba Mortgage brokers, offers an informed risk of protecting an one hundred% financial. We fill in your house loan application to numerous finance companies, capitalizing on the competition between your finance companies adjust your chances of getting your application approved.

I supply various units that can make property processes easier. Begin by all of our Bond Calculator , following explore our very own Bond Indication to see which you can afford. In the long run, when you’re ready, you might get a mortgage .